A Few More of Our Accounts

Christmas Club

Our Christmas Club accounts are an excellent way to save for the holiday season. No minimum deposit is required to open the account. Members may make deposits to the account on their own or set up a convenient automatic deduction. Christmas Club funds are transferred in Mid-October to the share savings or share draft account. If funds are withdrawn prior to the scheduled transfer date, an early withdrawal fee of $15 will be assessed for each occurrence.

Share Certificates of Deposit

Share Certificates of Deposits are offered to members who want a higher dividend rate (some restrictions may apply).

Convenient Money

The Convenient Money Certificate allows you to make deposits and withdrawals. The Certificates are available in 1 and 2 year terms. The rate is dependent upon whether the member is depositing a minimum of $1,000 or $10,000. Members are allowed to make 1 withdrawal and 1 deposit per month. The minimum transaction amount is $250. If the transaction amount takes the balance below the minimum balance required, a penalty will be applied and the certificate will be closed.

Individual Retirement Accounts

Members may save for retirement through this program. It is exactly like any other IRA account and generally pays higher dividends than other institutions. These are offered in the form of accumulation accounts or certificates, whichever the member prefers. I.R.S. maintains very strict regulations governing IRAs and members should consult their tax adviser for deductibility.

Insured Share Management Account - ISMA

This account is between a regular share account and a share certificate. The dividend rate is higher than a regular share account, yet it allows the member a limited number of withdrawals per month. There is a $3,000 minimum balance, and $500 minimum deposit or withdrawal. There is not a limit to the number of deposits allowed per month. We also offer a Jumbo ISMA - minimum balance of $100,000 with minimum deposit / withdrawal of $500.

To report lost or stolen VISA cards, call 888-241-2510

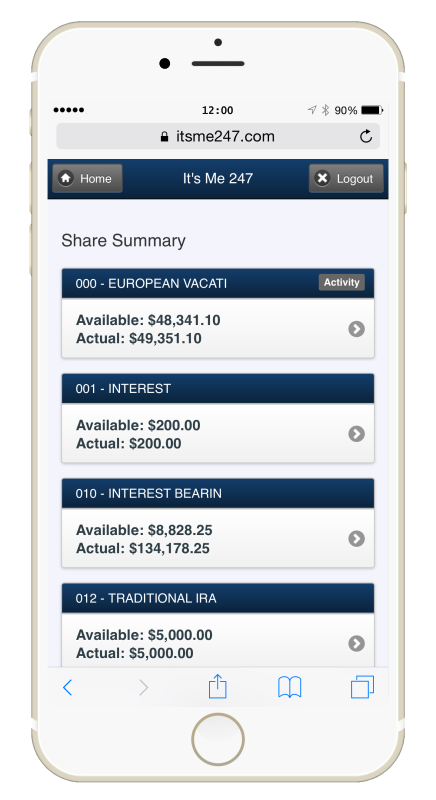

With It'sMe247 Online Banking, you can keep in touch with your credit union accounts any time, from any place life takes you! If you have a computer, smart phone, or tablet, and a connection to the Internet, you can use It'sMe247 to check balances, transfer money, and stay connected with your credit union accounts around the clock.

With Visa Platinum ScoreCard, qualifying net purchases made using your credit card earn points. You can redeem these points towards purchasing merchandise, airfare, hotels, travel packages, and more. To redeem your points, simply log on to www.scorecardrewards.com or call Award Headquarters at (800) 854-0790.

Other benefits of the Visa Platinum ScoreCard program include:

- No cost travel accident insurance up to $150,000 when you use your card to purchase travel tickets

- 25-day grace period on purchases

- No cash advance fees

- Interest rate is the same for purchases and cash advances

- No annual fee

We currently have 4 rate tiers in our Visa program:

| Name | Credit Limit | Rate Type | Rate |

| Visa Fresh Start | $500.00 | Fixed | 17.50%APR* |

| Visa Plus | $500.00 to $5,000.00 | Variable | 12 Points above Wall Street Prime |

| Visa Premium | $5,000.00 to $10,000.00 | Variable | 7 Points above Wall Street Prime |

| Visa Platinum | $10,000.00 to $15,000.00 | Variable | 4 Points above Wall Street Prime |

*Annual Percentage Rate

Pay your Visa bill, view previous statements/transactions 24-hours a day: